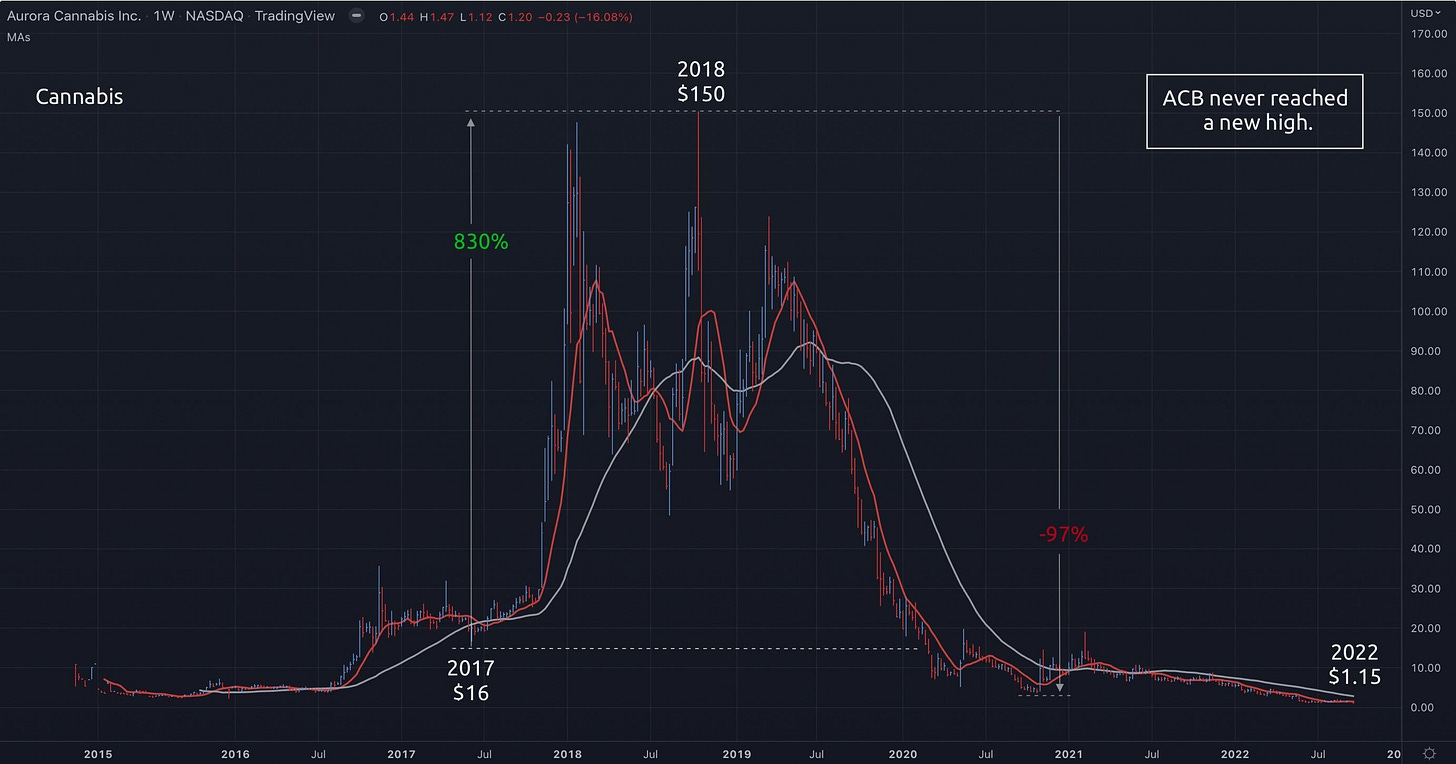

Throughout history, we have seen many speculative bubbles. The 1929 Crash, the DotCom Boom, Silver, 3D printing, and even cannabis.

All of these asset bubbles share similar characteristics. Each time they went through a familiar cycle, surging to a historic top, before giving back most, if not all of the gains and more. Following these crashes, prices typically don't go anywhere for a very, very long time.

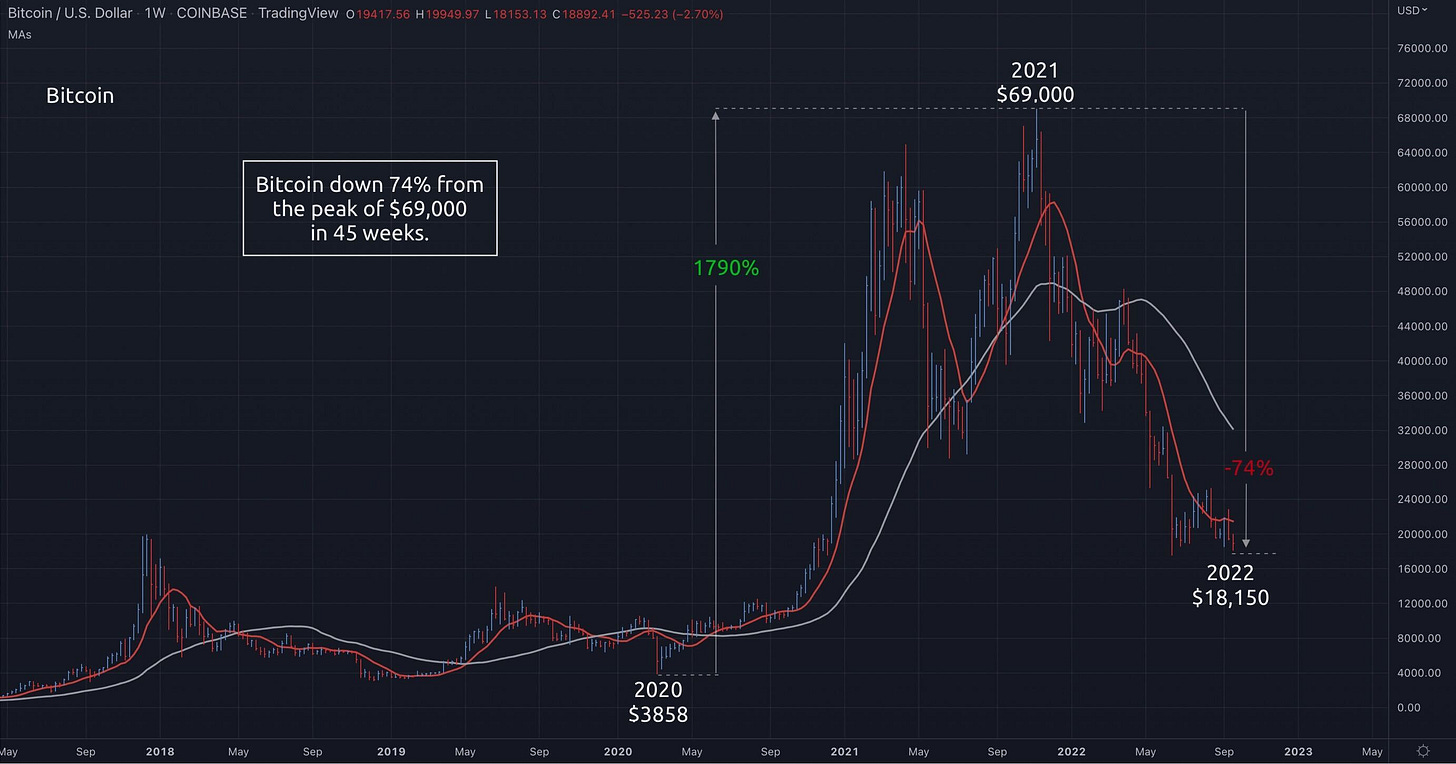

Investors are now seeing this pattern again as Bitcoin retreats from its frothy highs. And whether it becomes a model breaker and soon rises back to life, remains to be seen.

The intrinsic value of blockchain technology has provided some optimism for the crypto space demonstrated by its recent bounce, yet previous bubbles show just how brutal it can be following these short-term recoveries.

Many investors have been humbled by what appears to be a major rally, yet is ultimately a fake in an ongoing bear market.

A little perspective

It is important to remember that in a bear market, there will be rallies and in a bull market, there are going to be declines. However, in some cases, when you have what appears to be a real asset bubble, it is critical to respect that, and at the very least acknowledge that a genuine recovery typically takes quite a long time, even for quality prospects.

Investors must remember not to get caught in simply buying the dip, they need to look for appropriate entries. Quality opportunities will present themselves through positive relative strength, the right technical bases, and consequently, the shaper patterns that display the unique and specific characteristics of new trends forming.

Like in any trade, it is critical to maintain the correct mindset, remain neutral, and follow the money and the price action. And most importantly take emotion out of the equation.

The last paragraph really shines. I'm new...I admit it. But ..I think of all the people I know who have opinions and then get knocked off "neutrual". I was one. Loved my gold!! And I still do...but I'm not invested in it any more.

Reason?

Bad price action.