Weekend Summary

Markets have swung from extreme downside pressure to more neutral positioning. The question now shifts from “Is this a tradeable bottom?” to “Is this the start of a true bull market?”

Looking at the FOMO Indicator below, we’re due for a period of calm after several strong weeks. Given the dramatic upside reversals, the bulls don’t need to push significantly higher—they just need to maintain current levels and prevent downside momentum from returning. If the market can hold these gains through earnings season, we’ll be set to transition from an oversold bounce to a real test of all-time highs.

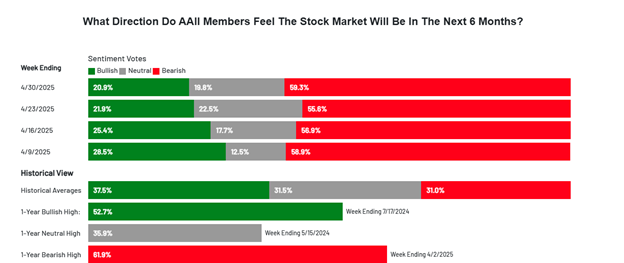

Mainstream Still Fearful

While our short-term sentiment readings have reached short-term FOMO territory, broader investor sentiment remains cautious. From Barron's headlines to AAII surveys, most participants are still shaken by the “Tariff Tantrum.” This persistent skepticism is the fuel that can drive prices higher—if the bulls can hold the line over the next couple of weeks.

What Can Drive the Market Higher Beyond Sentiment and Positioning?

Tariffs have introduced significant uncertainty, but the potential for trade deals brings multiple tailwinds. A deal would:

Reduce uncertainty

Offer improved trade terms

Provide the Federal Reserve with more room to ease policy

In short, we could get a stronger economic backdrop supported by a more accommodative Fed. While the risk of a deeper trade war with China still exists, the incentives on both sides are strong enough that a resolution remains more likely than not. China is the final piece of the puzzle.

Where to Focus?

We’ve been highlighting stocks like PLTR, NFLX, HOOD, and UBER for weeks due to their resilience during the bear market and strength as conditions improved. Caruso Insights shifted from full cash to a carefully managed increase in exposure, starting with PLTR on April 23rd. More recent additions include GEV and SPOT.

That said, many leading stocks are currently short-term extended. Our focus has shifted to selectively buying pullbacks and patiently waiting for pauses. Encouragingly, a number of high-quality growth names are now building classic bases and showing strong price action.

I include the following quote each week as it is a fundamental building block of this business. Year after year, O’Neil’s optimism helps me remain focused on the bright future markets bring.

“Don’t be thrown off by the swarm of gloom and doomers. In the long run, they have seldom made anyone any money or provided any real happiness. I have also never met a successful pessimist.” – William J. O’Neil

🚨 GIVEAWAY TIME 🚨

Win over $1,800 USD in trading education tools.

1 Year of Premium "Foundation Tier" Membership ($1,199 value)

Full Active Growth Investor Course ($699 value)

Here’s how to enter:

Follow us on Twitter: CarusoInsights

Subscribe to our YouTube channel: Caruso Insights

Comment on our Twitter contest post here with the hashtag: #CarusoInsightsContest25

📅 Contest closes on May 16, 2025

🏆 Winner announced May 20 via social mediaNo purchase necessary. Ready to win? Enter Now!

To your success,

Caruso Insights Team